4 key drivers of customer vulnerability

What is a vulnerable customer?

According to FCA, a vulnerable customer is “someone who, due to their personal circumstances, is especially susceptible to harm – particularly when a firm is not acting with appropriate levels of care”.

The FCA’s guidance includes 4 key drivers of customer vulnerability:

Health

Conditions or illnesses that affect one’s ability to complete day-to-day tasks, both mentally and physically.

Life Events

Such as bereavement, job loss or relationship breakdown.

Resilience

Low ability to withstand and manage financial or emotional shocks.

Capability

Limited knowledge of financial matters, lack of technological savviness or poor ability in areas such as digital communications and language skills.

Vulnerable customers policy

Each firm should define specific characteristics of a vulnerability that appear more commonly within their customer base and target market. For instance, financial advisory firms that work with pensions and investments may come across customers with vulnerabilities involving health or life events associated with old age.

Some characteristics of vulnerability are common across various customer segments and age groups. They can appear at any moment of time and overlap with or cause other vulnerability drivers. An example can be life events related to a loss of a partner, or interruption of the regular income. They can be coupled with digital illiteracy and lead to mental health issues like depression.

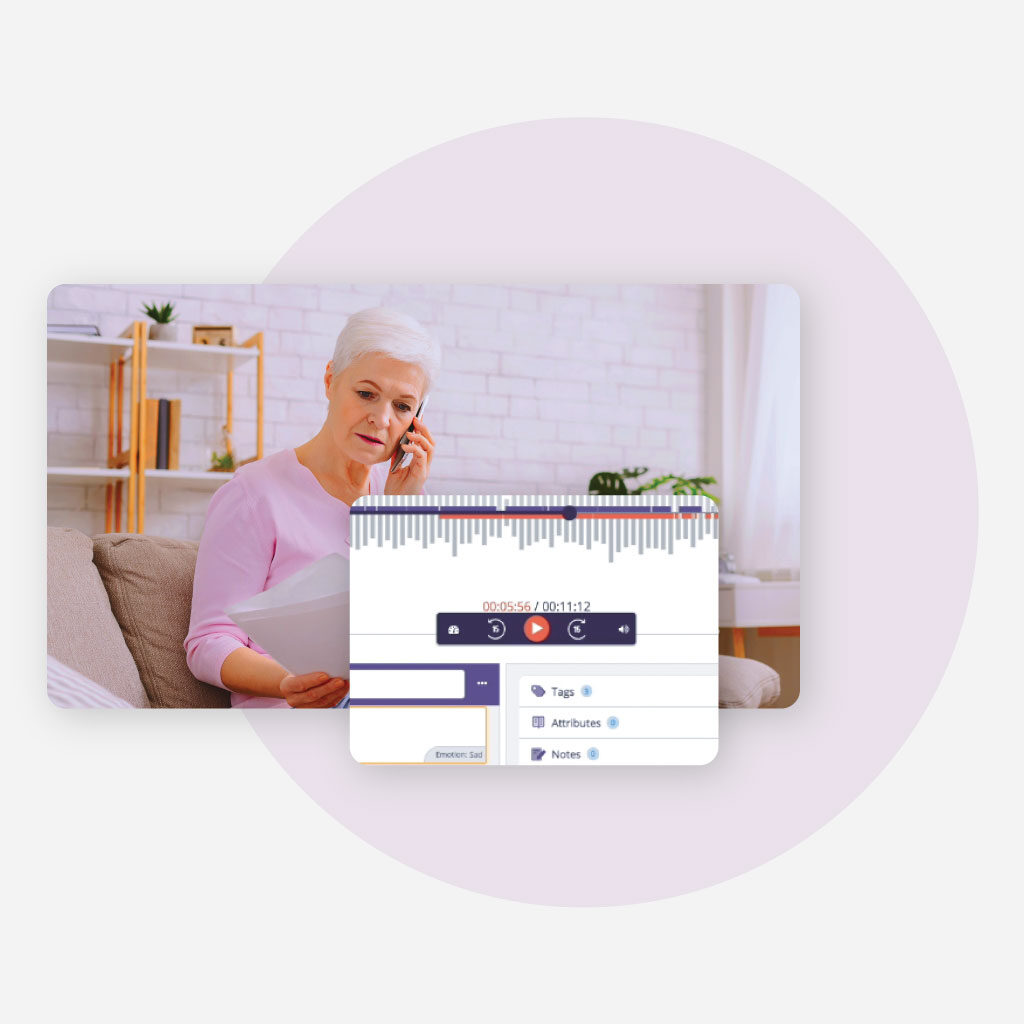

Download the Voyc white paper on vulnerable customers

- Why treating vulnerable customers is now a major regulatory and moral focus for financial services providers.

- How you predict likely vulnerability categories in your own business, using the FCA’s definitions of vulnerable customer categories.

- More details on how Voyc can help you monitor 100% of your customer interactions to maximise the effectiveness of your vulnerable customers policy.