Handle 100% of Interactions with Consistency and Care

Conversation Intelligence & Compliance Monitoring Software for Financial Services Firms

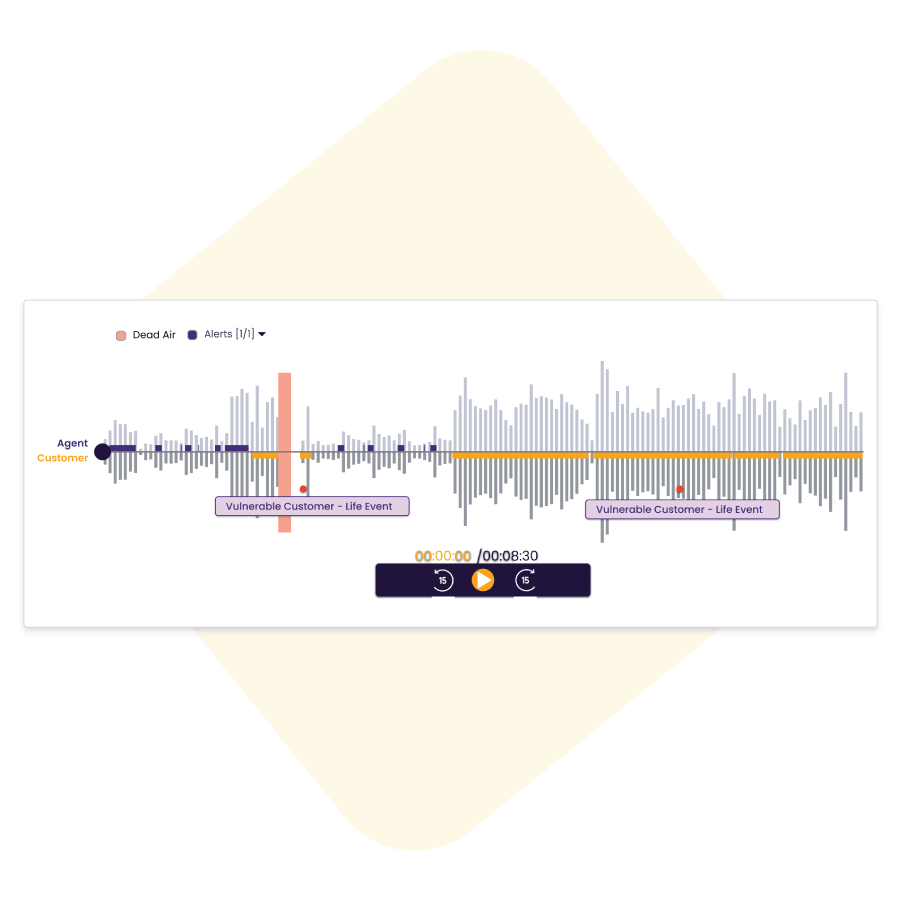

- Monitor Customer Interactions

- Act on Compliance Risk

- Report on Good Customer Outcomes

Trusted by dozens of leading financial services firms in pensions, investments, mortgages, protection, credit and collections

Building trust in your business by ensuring consistency and care in every customer interaction.

“Voyc has allowed us to have greater control over our recording and caring for clients that identify as having vulnerable characteristics.

The alerts are easy to use and mean our compliance team can in real time identify clients that our agents may miss as requiring extra care, and adapt our services accordingly. The alerts help us improve our client experience, recording for regulatory purposes and our business processes.”

Poppy Kelly

Clearly see how to improve your business performance with risk and performance insights from 100% of your customer interactions in one easy to use platform.

Regulators in consumer industries are steadily increasing their focus on consumer protection. Voyc helps regulated firms minimise the risk of compliance breaches in 100% of customer interactions – from the largest contact centres to customer-facing teams of just a few professional staff.

Voyc delivers detailed reports that can be configured to the precise needs of the business. Actionable management information (MI) and insight on customer interactions and outcomes, as well as robust data for evidence to regulators.

With Voyc, there are no capacity limits. It automatically monitors 100% of interactions, instantly recognising high-risk cases. And with Voyc’s powerful workflows you can go from insights to action as fast as possible.

In July 2022, the Financial Conduct Authority (FCA) introduced the Consumer Duty to enhance consumer protection. The Consumer Duty requires firms to demonstrate to the regulator how they consistently deliver good customer outcomes and ensure customer understanding. You can also find additional information in our Consumer Duty page where we go into detail on Consumer Duty outcomes, rules and even provide a checklist with the key steps you need to take to ensure compliance.

Backed by the best

Building trust in your business by ensuring consistency and care in every customer interaction.

What sets us apart

See value in less than

1 week

8.9 Ease of use Score*

G2.com, Inc.

2min Support Response Time

Bank-grade security

Want to know more – or arrange a free demo?

To find out more about how Voyc could help your business measure & monitor customer interactions to ensure consistency and care, simply complete the form below and we will get back to you.

If you’d like to book a free demo of Voyc in action on your own screen, click here to open the calendar and select a date and time of your choice.

Associations

Voyc is a proud member of the Consumer Duty Alliance, CCMA, Protect Association, and other industry associations.