Consistency in operating excellence

Wherever your business interacts with customers, Voyc can help – from the largest contact centres to small teams of customer-facing staff.

Voyc improves operational efficiency and helps you respond quickly to potential issues, before they become major problems – in key areas including call handling, Quality Assurance (QA), sales and collections.

Transforming call

handling efficiency

Voyc spots and highlights call handling errors and omissions that cost businesses money, time – and potentially their reputation.

Voyc sends instant alerts to focus attention on key problem areas, such as “red flag” words and missed compliance phrases. And it helps reduce handling times and the need for callbacks.

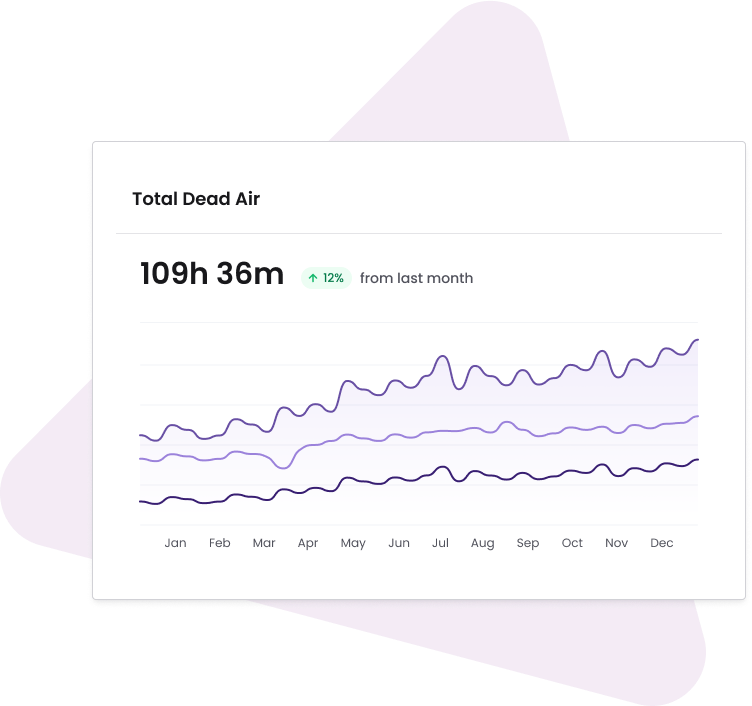

“Dead air” is another key issue that Voyc rigorously highlights. In fact, it has reduced dead air from 20% to just 3% of call time for some clients. That means much higher productivity without the cost of additional call handlers.

Focusing QA where

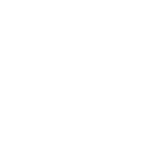

it matters most

Increasing regulation is putting pressure on traditional QA assessors. They need to monitor enough interactions to ensure compliance – and provide sound evidence whenever requested. But most QA teams only have time to monitor a small fraction of interactions: on average about 2%.

Voyc takes care of 100% of the monitoring – leaving the QA teams to focus on any issues as they arise. And to deliver quality coaching and training where it’s needed most.

Boosting quality

sales growth

Voyc isn’t limited by volume. You can increase your sales team as required and still enjoy 100% monitoring.

Customised MI and analytics give you deep insight for effective sales management – and provide solid evidence in the event of complaints, disputes and regulatory requests.

In regulated markets, Voyc adapts to advised and non-advised sales and helps ensure that advice is only given where permitted.

Managing and improving sales performance is another benefit. Voyc generates call quality scores that you can use to calculate remuneration.

And you can support the quality of sales calls easily using Voyc’s drag and drop call guide builder. This ensures that conversations remain natural – providing customers with the correct responses and information they need at every stage, whichever direction the call takes.

Supporting collections success

With rising living costs impacting customers, collection of unpaid accounts is now a key focus for many businesses – not least collections agencies.

What’s more, regulators are raising their expectations for the treatment of financially vulnerable customers.

Voyc allows firms to:

- Understand the key factors that drive successful collections calls.

- Coach and train underperforming or even anxious staff to achieve better outcomes.

You can even configure Voyc to identify and raise alerts on calls where words, phrases and even sentiment indicate that a customer or agent is stressed or showing vulnerability.

This allows designated team members to intervene with additional support before things escalate into a more serious problem.

What sets us apart

See value in less

than 1 week

8.9 Ease of

use Score*

G2.com, Inc.

2min Support

Response Time

Bank-grade

security

Voyc’s Star Rating on the leading software review forum, G2.com is 4.4 out of 5. (Source: G2.com, Inc.)

Get In Touch

If you’d like to book a free demo of Voyc in action on your own screen, click here to open the calendar and select a date and time of your choice.